Cape Cod Copes With Rising Inflation

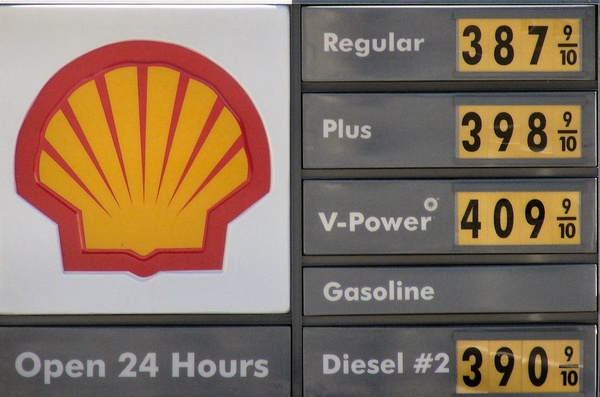

Inflated gas prices

November 10, 2021

Prices everywhere have soared. US inflation reached its highest rate in 31 years at 6.2 percent in October. Housing is at an all time high, the stock market is breaking records, and the price of gas has eclipsed $3 once again.

First, to define what inflation is: according to Forbes, “Inflation occurs when prices rise, decreasing the purchasing power of your dollars.” Many argue that this is simply the result of the Covid-19 pandemic shutting down businesses and the international manufacturing supply chain for so long.

Justin Ogilvie, a new business teacher at BHS, said “The last 18 months have given us a multitude of unforeseen experiences, terrible luck, and shortages of things. We see this reflected in the rise in prices, which sellers have had to pass onto consumers.”

This is one of the ways inflation occurs: undersupply. Cape Cod saw this with the rise in wages. Some believe President Joe Biden’s monetary policy made it so that many were making more money by not working at all. “I think what’s going on is that people are staying home and getting $2 more an hour than they would for working,” said Curt Felix, owner of Mosquito Squad of Cape Cod in the Cape Cod Times. With few people willing to work, they were forced to rapidly raise wages to attract workers. Companies often then increase prices to offset these higher labor costs, resulting in inflation. In October, 53 percent of small businesses raised prices according to the National Federation of Independent Business.

Undersupply also drove Cape Cod’s roaring real estate market. A surge of demand came from wealthy out of town buyers who were chasing an incredibly small inventory of homes, resulting in higher pricing. This increase in the price of residential real estate on the Cape also forced many working class people out. They simply could not afford to pay for housing, causing the already small pool of workers to shrink.

Ogilvie said he also noticed this phenomenon when it comes to the rising cost of education. “If you take a look at the cost of education back when I was in high school to what it is now, it’s crazy. Is the value of education really better now than it was then?” said Ogilvie who graduated from UMass Dartmouth in 2017.

Colleges of course work like any other business, they pass inflation on to their consumer, in this case, students.

The second way inflation occurs is through the government injecting massive amounts of money into the system.

We see this reflected in the rise in prices, which sellers have had to pass onto consumers — Ogilvie

The Federal Reserve, which is the central bank of the United States, has kept interest rates at zero, meaning that there is endless easy money to be had. The Fed has pushed massive amounts of credit into the banks, but the real question is where does these seemingly limitless credit come from? Really, the answer is from nowhere. Dollars are added electronically, and the money supply is increased instantaneously. Couple this with new massive spending bills, which have added to the national debt and forced the Fed and the US Treasury to continue these money printing policies.

According to some economists like National Economic Council Deputy Director Bharat Ramamurti, some inflation is good. It will cause people to pull from their savings, in fear that their money is becoming worthless, and spend it, resulting in economic growth. However, the danger is if people choose to save their money, or there is no economic growth, there will be stagflation. In September, US consumer spending rose just 0.6 percent according to the Commerce Department. Stagflation is “a noxious blend of stagnant growth and rising prices” according to the Wall Street Journal. This is becoming an increasingly likely proposition especially with recent jobs reports compared to the inflation rate. According to the Labor Department, September’s rate of inflation was a 13 year high of 5.4 percent. That same month, the US added 194,000 jobs, brutally missing the estimate of 500,000. This is the danger: even as money is being blown into the economy, the ability to supply through jobs simply cannot keep up with demand. Nonetheless, inflation completes the cycle as the basic rules of supply and demand take effect.

Of course, many high schoolers don’t think as much of it because they are not the main people being affected. Junior Liam McCarthy said “I wouldn’t really say it has a massive effect on me, as I’m not really paying for anything, but I would say more so on my parents who are actually paying for things. They definitely notice the effects on prices as they are rising.”

Investors have also seen prices of public securities skyrocket. McCarthy, who is also avidly interested in the stock market, referred to the trillions of dollars of liquidity that Fed had injected into the public markets through a process called quantitative easing or (QE) “Just pumping in money creates the misconception that the stock market is doing really well, creating a false reality for investors as well as the general public,” said McCarthy.